Delivering the benefits you want.

As you probably know, your primary health insurance covers your basic medical expenses like doctors’ visits, lab tests and prescription drugs ― as well as some other benefits. But your medical plan can’t cover everything. Having a supplemental plan can offer additional benefits.

Supplemental or voluntary insurance, available through your employer, can provide financial assistance and help cover co-pays, deductibles, co-insurance and even out-of-network fees.

Atlantic American plans and policies are yours for life. Even though you may purchase our products at work, you own your policy – not your employer. There are many reasons to keep your plan if you change jobs or move. Your new employer might not offer a similar plan, and if they do, an increase in your age can make a difference in your cost. Luckily, Atlantic American makes it easy to keep your plans.

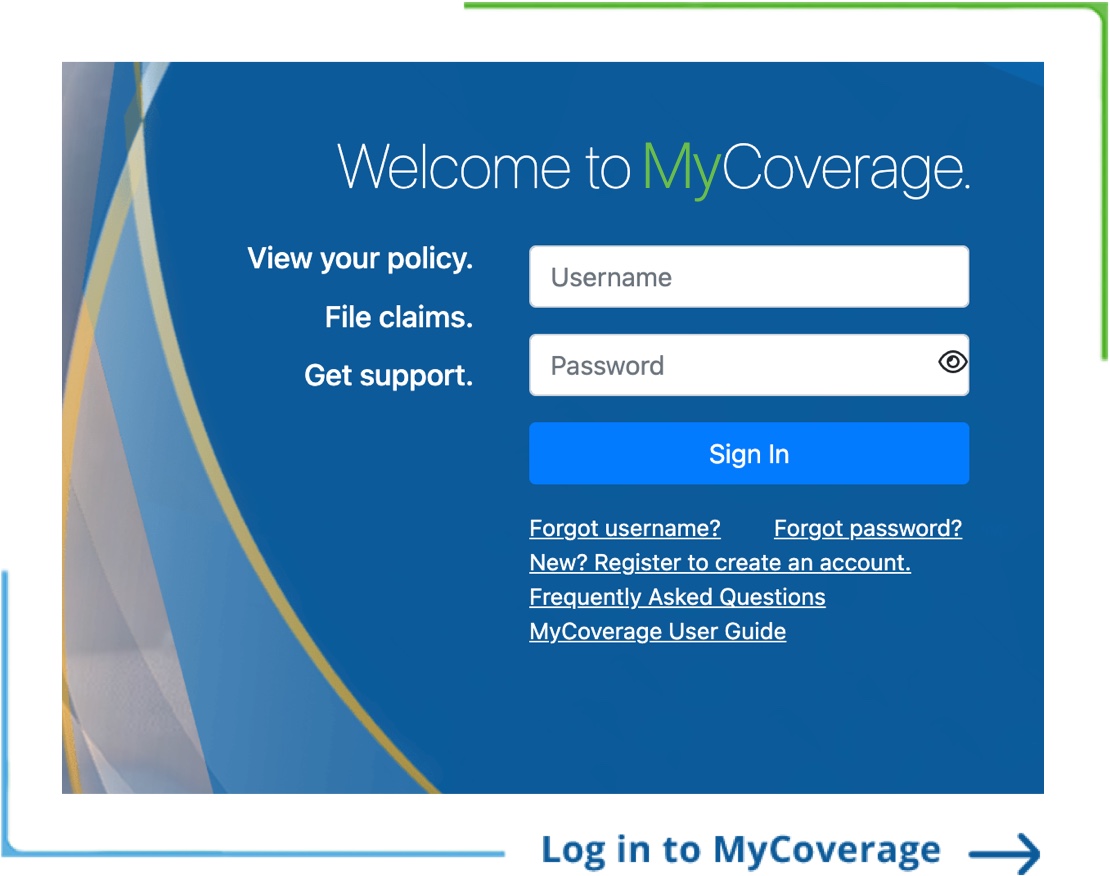

Secure Online Access to Your Claims and Coverage Information

Our secure MyCoverage portal provides you with real-time access, 24 hours a day. You can log in on laptops, mobile devices or tablets to view your personal policies and benefit details, update personal and contact information, and quickly file claims online.

- View coverage & benefit information

- File Claims*

- Download forms & Explanation of Benefits

- Check claim status/claims history

- Update electronic communication preferences & profile

- Contact Atlantic American Employee Benefits home office

*Not available for all products.

Download Our Guide to Register Now

Our commitment to fair and fast payment of claims has earned us a reputation for quality service to our policy owners. Every employee is treated with respect, empathy and care and we promise quick responses to phone and mailed inquiries. All members of our Customer Care and Claims teams work together seamlessly to provide a superior customer service experience.

Our Voluntary Benefits

Help protect your family from the out-of-pocket costs of an accident

Our Accident Insurance plan complements your group health insurance and helps cover unexpected expenses that result from all kinds of accidents, even sports-related and household ones.

The cash payment can be used any way you want: to meet out-of-pocket medical costs like deductibles/co-pays and non-medical costs like childcare.

Value of Accident Insurance

- Pays benefits for a covered accident or injury

- Spouse and children coverage available

- Benefits are paid directly to you, regardless of other health insurance

- Provides an extensive range of benefits

- Benefits are portable, take it with you if you leave or change jobs

Critical Illness Insurance is a supplemental insurance plan that helps you pay for out-of-pocket costs after a covered health event

The costs of having a serious illness and its treatment are often overwhelming. Even with health insurance you may still struggle with covering out-of-pocket costs. Critical Illness Insurance can be a safety net for you and your family when you’re the most vulnerable.

Value of Critical Illness Insurance

-

Benefits payable for Critical Illness and specified diseases

-

Premiums are convenient and paid through payroll deduction

-

Coverage is guaranteed with no medical questions asked

-

There are no deductibles, copayments or network

restrictions—you choose your own medical provider -

Benefits are portable, take it with you if you leave or change jobs

Everyone deserves protection against hospital bills

Hospital stays can be pricey and often unexpected. Even the best medical plans can leave you with extra expenses to pay or services that just aren’t covered, i.e. plan deductibles, copays, extra costs for out-of-network care, or non-covered services.

Many people aren’t prepared to handle these extra costs, so having extra financial support when the time comes may mean less worry for you and your family.

Value of Hospital Indemnity insurance

- Cash benefit for unplanned or uninsured expenses resulting from a hospitalization due to sickness or injury

- Premiums are convenient and paid through payroll deduction

- Coverage is guaranteed with no medical questions asked

- There are no deductibles, no copayments and no network restrictions

- Benefits are portable – take it with you if you leave or change jobs

Short-Term Disability Insurance is the most important financial product you didn’t realize you need

Disabilities are more common than you might realize, and people can be unable to work for all sorts of different reasons. In fact, the most common reasons for short-term disability claims are pregnancies, musculoskeletal disorders, digestive disorders, mental health issues and injuries like, sprains and strains.

Value of Short-Term Disability Insurance

- Protects your income when you can’t work

- Provides you with a weekly paycheck for covered injuries and illnesses—paid directly to you

- Premiums are convenient and paid through payroll deduction

- No benefit reduction—income from other sources, including

Social Security or Workers’ Compensation, will not reduce your benefit - Waiver of premium: your premiums will be waived while disability benefits are payable under the policy*

* Waiver of premium applied once the covered employee satisfies the elimination period and begins receiving disability benefits.

Give yourself protection for a lifetime

Many people buy life insurance to provide financial protection for those left behind. What if your life insurance could also provide benefits if you suffer from a permanent health condition and you require ongoing care from a family member or professional caregiver?

Value of Whole Life insurance

- Permanent Life insurance

- Living Care benefits for chronic illnesses

- Guaranteed premiums and death benefits

- Accumulates cash value1

- Payroll-deducted premiums

- Portable at the same rate and benefit amount

[1] Access to cash values through borrowing or partial surrenders will reduce the policy’s cash value and death benefit, increase the chance the policy will lapse,

and may result in a tax liability if the policy terminates before the death of the insured.